Renters Insurance in and around Jacksonville

Welcome, home & apartment renters of Jacksonville!

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

Calling All Jacksonville Renters!

No matter what you're considering as you rent a home - number of bedrooms, number of bathrooms, outdoor living space, house or condo - getting the right insurance can be valuable in the event of the unexpected.

Welcome, home & apartment renters of Jacksonville!

Rent wisely with insurance from State Farm

State Farm Has Options For Your Renters Insurance Needs

The unexpected happens. Unfortunately, the possessions in your rented townhome, such as a coffee maker, a desk and a stereo, aren't immune to fire or tornado. Your good neighbor, agent Danny Dupree, wants to help you know your savings options and find the right insurance options to insure your precious valuables.

It's never a bad idea to make sure you're prepared. Get in touch with State Farm agent Danny Dupree for help getting started on coverage options for your rented home.

Have More Questions About Renters Insurance?

Call Danny at (904) 757-8450 or visit our FAQ page.

Simple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.

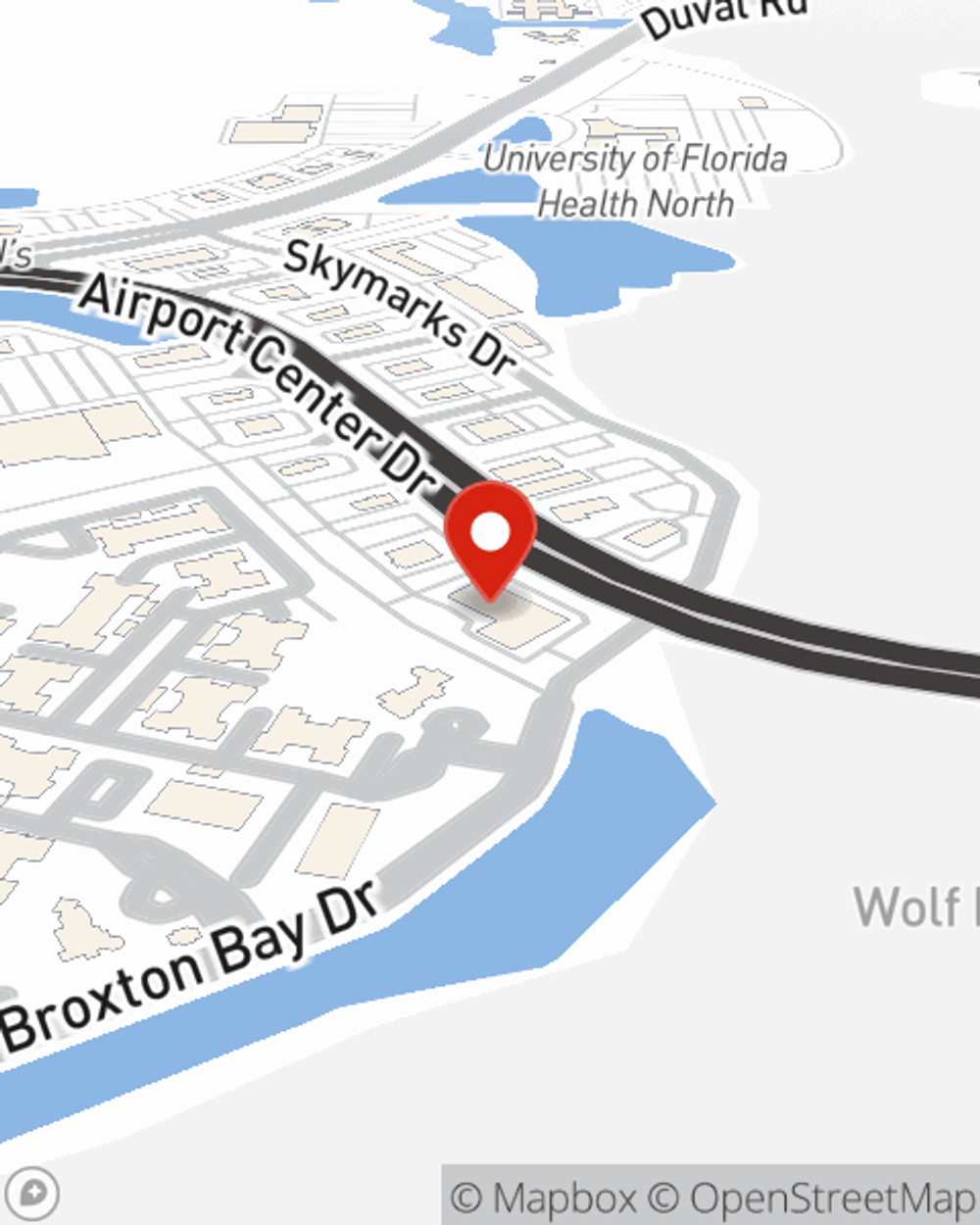

Danny Dupree

State Farm® Insurance AgentSimple Insights®

How to choose a neighborhood that is right for you

How to choose a neighborhood that is right for you

The trick to choosing a neighborhood to live in is to figure out what matters to you and to do thorough research.

Tips for dealing with lead paint

Tips for dealing with lead paint

Homes built before 1978 might contain lead-based paint -- one of the most common causes of lead poisoning, according to the Environmental Protection Agency.